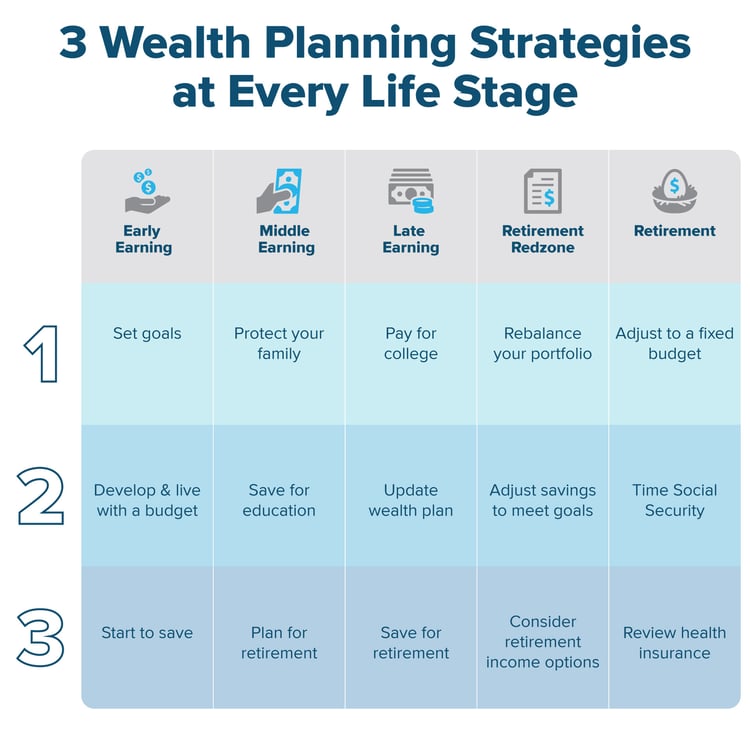

Three Wealth Planning Strategies for Every Stage of Life

Wouldn't it be lovely if retiring were a hassle-free process? Even better, what if you had a robotic personal assistant who handled all of your financial obligations?

You would just log in every morning to receive a report from your virtual helper. "I began your child's college savings plan and purchased your life insurance today. I adjusted your investing portfolio as well. You'll be able to retire at 67 years and 4 months.

When you have that app, let us know!

Here is a checklist with important actions to take at each stage of life in the interim, so you can potentially retire whenever you choose and enjoy the retirement of your dreams.

Early

Early

Early earning years

Creating sound financial habits early on is crucial. Setting objectives, creating and adhering to a budget, and starting to save are three crucial tasks.

What are your objectives? You can be eager to see the world, advance your education, or purchase a home. Retirement is something you're probably not considering in the beginning of your career. Yet you ought to be!

Create a monthly budget that accounts for living expenditures in order to reach your goals. If you have any unpaid loans, include a strategy for paying them off. Spend the remaining funds on saving for your objectives. You might need to divide your savings into numerous buckets because each will have a distinct time span. One bucket might be for a short-term purpose with a time frame of under five years, and another might be for a long-term goal with a time frame of more than 30 years.

Consider keeping your short-term funds in a highly liquid account, like a money market fund. Consider investing in stocks to increase the value of your money, but, for longer-term assets.

The longer-term category also includes saving for retirement. Start by enrolling in the retirement program offered by your employer, such as a 401(k) or 403(b) plan. An advantage of an employer-sponsored retirement plan is that your contribution is automatically withheld from each paycheck before you see it and invested in the funds of your choice. You should take advantage of the free money if your employer matches a portion of your payments. Contribute up to the match percentage, then anything after the match, take the funds and invest in better investment options outside of your 401k. It might eventually assist in funding 30 years of retirement if let to develop for many years—potentially a considerable sum! But if you begin later in life, when you have fewer years to build your money, it is more difficult to achieve this. Start off early.

You can make contributions to an IRA whether your employer has a retirement plan or not. The limits for employer-sponsored plans and IRAs are different, so having both may affect whether you may take a tax deduction. A Roth IRA does not offer a tax deduction for your contribution, but your money grows tax-free for the rest of your life. If you don't have a company plan, you may be able to deduct up to $6,500 of your standard IRA contribution from your taxes.

Middle earning years

Your goals may change to include establishing a family and purchasing a home as you get older and more established in your job. Your income may also increase. At this point, it's important to secure your family, save money for your children's education, and make retirement plans.

Life insurance is important prior to having children. But you need to update it once you have children. Term and permanent life are the two fundamental sorts. Each has benefits and drawbacks, so consult with an insurance expert to help you select the right strategy for your need. Based on its investing options.

As soon as you can, you should begin setting money aside for your children's education. A 529 plan is often opened in order to accomplish this. Additionally, a 529 plan offers enticing tax benefits for both contributions and withdrawals. You can save without even realizing it if you make a monthly automatic contribution to it.

Finally, continue your retirement savings. We are aware that this can become difficult, especially if you also have family obligations and a new mortgage. However, putting money aside for your retirement is the greatest method to be sure you'll have money to support yourself in your older years. Therefore, budget as much as you can—ideally, enough to benefit from any employer match that is provided, which could range from 2% to 4% of your salary. That is free cash!

Late earning years

Both income and expenses will probably be at or very close to their peak at this point. The three most important things to focus on now are paying for education, updating your investment portfolio, and (surprise!) saving for retirement.

Utilize the different alternatives available to you to pay for your college. But let us give you some advice: Despite how much you may love your children, we advise against using your retirement funds to pay for their schooling. Although that may sound harsh, consider this: To pay for their education, your children are able to take out loans. You are not permitted to take out a loan for retirement. Unfortunately, people who choose to forgo retirement savings in favor of funding their children's education risk becoming dependent on them in later life. If you can help it, don't put that financial load on your children.

Review your wealth plan in detail. Determine whether your retirement plans are on track and make any necessary changes to your savings rate, asset allocation, and time horizon.

Continue your retirement savings as a final step. Never forget to set a reminder. Check it at least once a year.

The “red zone” before retirement

The roughly five years before to retirement are a crucial period to make important changes. Rebalancing your portfolio is one of them, along with altering savings to match goals and taking into account retirement income choices.

Your salary is probably at its highest level right now, you should have paid off all of your major expenses (like college) and be well on your way to supporting your retirement. Therefore, if you need to raise your savings to achieve your goals, the time is now.

Consult your financial advisor to see whether your retirement portfolio's asset composition is appropriate and whether you need to develop a cash carve-out strategy. At this point, many people opt to be less exposed to market fluctuations (more cautious, less growth), but they frequently overlook the fact that retirement might last for two or more decades.

In order to avoid worrying about unforeseen expenses or a market downturn while the rest of your portfolio grows, instead of moving toward a too-conservative portfolio allocation, you might want to think about setting aside three to five years' worth of living expenses in a liquid portfolio—a cash-carve out. The secret is to maintain portfolio growth while maintaining faith in your ability to cover expenses without having to sell during a market downturn.

Some people think about how an annuity can help them in retirement. Between a buyer (the annuity holder) and an insurance provider, annuities are insurance contracts. In order to obtain a benefit in the future, the consumer contributes to an annuity now. These also have guaranteed lifetime income, which is key in retirement.

Retirement

At this point, it's important to adjust to a fixed budget and income loss, time Social Security, and examine your health insurance, among other things.

You've spent the most of your career working toward retirement. Although it's an exciting time, there will be a lot of adjustment. The change in daily routine is challenging for many people. Others also struggle to adjust to the loss of a reliable source of income. As a result, some retirees favor working a part-time job. This generates additional cash while keeping them occupied, content, and active.

You'll need to make a decision about when to collect your Social Security payments as you approach retirement. If you don't need the income, you can wait until age 70 and submit your application at age 62. There are some important factors to take into account. You can also have an advisor perform a social secuirty optimization strategy for you, this could include the timing of filing as well as how to use a social security bridge, if needed.

In order to meet your needs for income and growth, you should review and modify your investment portfolio at the same time. The assessment includes determining your required minimum distributions (RMDs) from your traditional IRA and 401(k).

Health insurance, which may also include long-term care insurance, is a crucial step at this point. The final three to five years of life can be extremely expensive in terms of health care. The cost of long-term care insurance might be lower.

Planning is key at every stage

Consulting an advisor at each stage of your life may make sense if you don't already have one. This is especially true if you find it challenging to set goals and design a plan to achieve them. Your planner will assist you in getting back on track, ensure that your investments are suitable, and control your investment behavior so that you don't emotionally respond to market fluctuations.

Contact me at [email protected]

Check out our website at www.retirewisepro.com

#RetireHappy #retirementplanning #Financial Planning

Retirement Planning