Plan for Tax-Smart Retirement Income

Fortunately, not all investments are subject to the same tax treatment, and if you liquidate them in a tax-efficient way, you could help your savings last longer.

In light of this, here is a methodical process for taking tax-advantageous withdrawals during retirement.

First, take your RMDs.

Take the required minimum distributions (RMDs) from your tax-deferred retirement accounts first if you're 73 years of age or older. If you don't, you'll be penalized 25% of the amount that was required and the amount that you withdrew.

The majority of financial institutions can assist you in calculating your required minimum distributions (RMDs) when the time comes, or you can use an online calculator to estimate them beforehand. Because of the penalty, RMDs should be your first priority when accessing your retirement portfolio.

If you don't need the money for living costs, think about putting it into a taxable brokerage account where you could be able to use it again in the stock market. Anything you remove will be taxed as ordinary income.

Step 2: Use profits and interest

Subsequently, take out of your taxable accounts the interest and dividends, but not the initial investment. If the initial investment is left alone, it will be able to grow and might eventually produce extra interest and/or dividends.

Unless it comes from a tax-free municipal bond or municipal bond fund, interest is subject to ordinary income taxation. On the other hand, dividends are frequently subject to the lower capital gains rate of 0%, 15%, or 20%, depending on the amount of income—as long as certain conditions are satisfied, like minimum holding periods.

Step 3: Recover principle on CDs and bonds that are aging

Bonds and certificates of deposit (CDs) are a common source of income for retirees. By purchasing bonds and/or CDs with varying maturity dates and reinvested the principal as each matures, you may gradually level out the yields in your portfolio and ensure a consistent flow of income from interest payments.

However, the principle from a maturing bond or CD is frequently the next place to turn if you still need money after using up your interest and dividends, RMDs (if you're of age), and other resources.

If you stay onto a bond or CD until its maturity date, you generally won't owe any taxes on your original investment; if you sell it early and make a profit, however, you will be subject to capital gains taxes.

Step 4: As needed, sell extra assets

You'll need to sell more assets to make up the difference if the money you make from Steps 1 through 3 isn't enough to pay your bills. However, which accounts—and to what extent—should you access first?

It is possible for your tax-deferred assets to increase until your RMDs come into effect if you empty your taxable brokerage accounts first and you have modest tax-deferred savings or if your RMDs are unlikely to put you in a higher tax bracket. To most effectively access your taxable accounts:

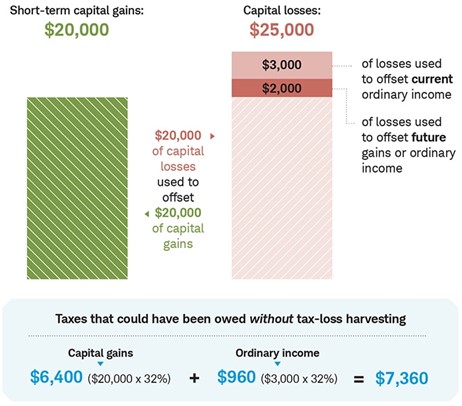

- First, sell any investments that have depreciated in value. Tax-loss harvesting is the practice of using your losses to offset any potential gains (see "Using a tax loss to get a tax break" below). Furthermore, in the event that you generate no capital gains, you may deduct up to $3,000 from your annual ordinary income until all of your losses have been deducted. To avoid having your losses disallowed, make sure you don't break the wash sale rule by buying the same or "substantially identical" securities again within 30 days of the sale.

- Next, in order to benefit from lower long-term capital gains tax rates, concentrate on selling investments that you have owned for longer than a year. As part of your routine portfolio rebalancing, you can sell these appreciated investments, utilizing the proceeds to cover your expenses and reinvesting the remaining in underweight portions of your portfolio.

- It's possible that your RMDs, especially after deducting Social Security, pensions, and other income, will place you in a higher tax rate once they become effective if you have sizable tax-deferred savings. You might want to think about taking out your taxable savings and your tax-deferred accounts at the same time if you think this would be the case.

Using this method, you withdraw money in proportion to the balances from your taxable and tax-deferred accounts. Let's take an example where you have $1 million in savings, $800,000 in a standard individual retirement account (IRA) and $200,000 in a brokerage account. Using the previously discussed tax-efficient withdrawal technique, you would withdraw $40,000 (80%) from your tax-deferred IRA and $10,000 (20%) from your taxable brokerage account if you needed $50,000 from your portfolio to cover your expenses.

This tactic can lessen the overall amount of taxes you pay in retirement by mitigating the possible income rise brought on by RMDs. You should still draw down your tax-deferred accounts in a way that maintains your goal asset allocation, even though the sequence in which you sell them won't matter tax-wise because distributions from these accounts will be taxed as regular income.

Obtaining a tax advantage by using a tax loss:

With tax-loss harvesting, an investor who, in a hypothetical scenario, realized $20,000 in short-term capital gains and has $25,000 in unrealized capital losses could reduce her tax liability.

Source: Schwab Center for Financial Research.

Assumes a combined federal and state marginal income tax band of 32%, with ordinary income tax rates applied to short-term capital gains. The example is purely hypothetical and meant to serve as an illustration. It is not meant to serve as a representation of any particular financial product, and the example does not account for fees.

Step 5: Hold off on accessing Roth accounts.

In general, you should wait as long as feasible to access your Roth assets because: Withdrawals are fully tax-free beginning at age 59½, as long as you have owned the account for five years or more.

RMDs do not apply to Roth IRA funds, so you can leave them to grow for the duration of your life. (Note: RMDs will not be required for Roth 401(k)s starting in 2024; they will be required for tax years 2023 and prior).

Your heirs can also benefit from tax-free withdrawals. The laws could always change, but at least for now, it's one of the best assets you can pass on to the next generation.

It might make sense for certain persons to roll over any existing Roth 401(k) accounts into a Roth IRA because Roth 401(k)s are subject to RMDs, unlike Roth IRAs. But be warned that unless the funds are transferred into an already-existing Roth IRA, in which case they benefit from the holding term on that account, converting a Roth 401(k) to a Roth IRA may reset the five-year holding requirement.

It is recommended that you consult a financial counselor before making any decisions on a rollover, and seek assistance if necessary.

Although several retirees derive pleasure from actively overseeing their investments, others may prefer not to become mired down in the complexities of managing their withdrawals and taxes.

It can be difficult to decide which assets to sell, so some savers would be better off consulting a financial advisor. In any case, controlling your tax liability will help you retain more of your money and possibly increase the longevity of your savings.